Menu

Save 19% VAT on batteries, PV and accessories

According to Section 12 Paragraph 3 Number 1 Sentence 1 of the German VAT Act (UStG), the tax is reduced to 0 percent for the supply of solar modules to the operator of a photovoltaic system, including the components essential for the operation of a photovoltaic system and the storage devices used to store the electricity generated by solar modules, if the photovoltaic system is installed on or near private residences, apartments, and public and other buildings used for activities serving the common good.(Source: BMF, Letter (coordinated state decree) III C 2 - S-7220/22/10002 :010 dated 27.02.2023)

When does the regulation come into effect?

The zero tax rate (0% VAT) applies from January 1, 2023.

What are the requirements? are requirements to be met?

1) The delivery address is in Germany.

2) The maximum power output of the PV system to be installed/installed is less than or exactly 30kW (30 kilowatt peak).

What do i have to do?

Items eligible for tax exemption can be identified by the note "The stated price includes 0% VAT in accordance with § 12 para. 3 no. 1 UStG.". This is located below the price information.

VAT: When ordering, the box next to § 12 para. 3 no. 1 UStG must be confirmed by you so that you can purchase from us at the zero tax rate (0% VAT).

Why do we still display "Including 0% VAT" for items with 0% VAT, even though there appears to be no VAT included?

Please do not be misled by this information. It is a legally correct indication of the zero percent tax rate. This means that the VAT included is 0% VAT instead of 19% VAT.

Legally, we are not able to advertise products to consumers as "without VAT." Therefore, we use the wording "Including 0% VAT." This does not change anything for you when placing your order.

Where can I find more information regarding the zero tax rate?

Further information can be found on the website of the Federal Ministry of Finance, which we have linked here: Federal Ministry of Finance Annual Tax Act 2022

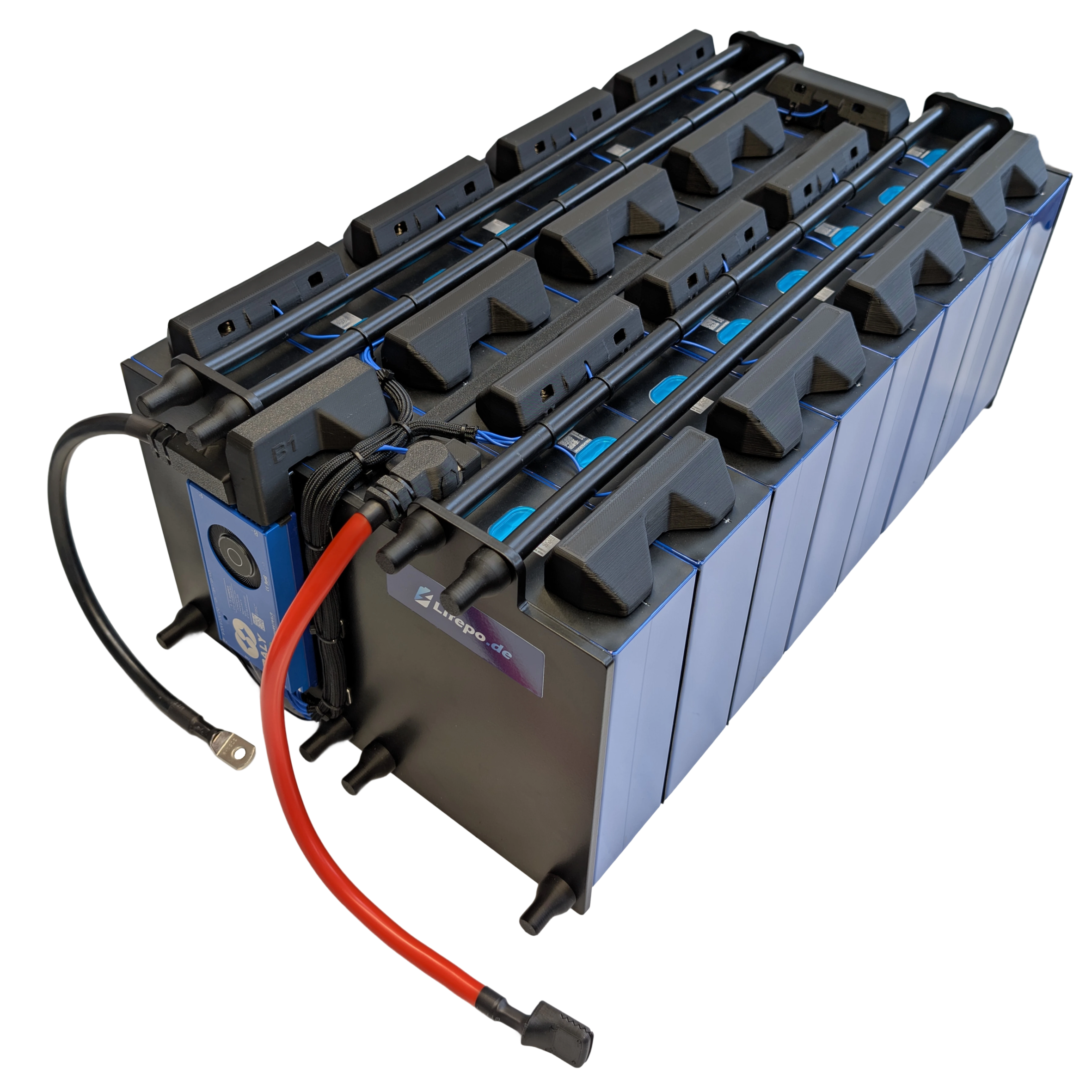

Have we piqued your interest? Then shop our Lifepo4 battery kits here:

Lifepo4 battery kits

- If you make a selection, the page will be completely updated.